Viable System Model

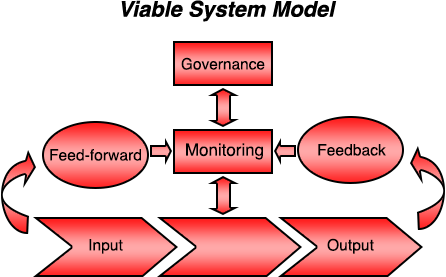

Risk management systems control risks in order to enhance performance. Viable risk management systems can be complex, with many benefits, but our summary model is:

Z/Yen works through the seven elements of the viable systems model with clients in order to deliver viable risk management systems, for example:

| System Module | Managers | Central Risk Unit |

|---|---|---|

| Inputs | Training, risk assessment data, knowledge management 'nets' | Selection, scheduling, incident alerts, near misses, |

| Processes | Day to day management, peer reviews, project management | Risk assessments, premium calculations, risk/reward models |

| Outputs | Safer operating procedures, reduced process variability, fairer appraisal mechanisms | Reduced insurance premiums, better risk practices, improved performance |

| Feedback | League tables, benchmarking, premium costs, risk databases | Financial results, perceived fairness, risk publications |

| Feedforward | Premium reduction agreements, new behaviours | Strategic direction, corporate 'scorecards' |

| Monitoring | Operational improvements, standards accreditation | Improved management information, internal market |

| Governance | Board direction, cost of capital charges | External pricing mechanisms, e.g. captives and re-insurance |

For example, in one organisation, each project, site and legal entity obtains a notional insurance premium from a central risk management unit. The premium covers the manager of the entity from a variety of financial and operational risks, permitting him or her to achieve P&L objectives within a framework of calculated risk. Some of the risks are financial, others are softer, e.g. damage to prestige or loss of quality certification. Managers reduce risk, often using best practice from elsewhere in the organisation, but must notify the central risk management unit of possible claims within short timescales, providing new information on near misses. The central unit publishes information to reduce the ‘losses’ of all its customers. This all sounds like transfer pricing and ‘playing shops’, but it has a real impact. The central unit has to put a price on the risks managers do and don’t assume and is subject to clear performance measurement – internal audit with carrots and sticks. Managers see the financial implications of many of the softer decisions they make through a unified reporting system and can show the financial benefits of longer-term projects which reduce risk, e.g. a new preventative system will reduce their notional premium.

Z/Yen is ideally placed to help clients with viable risk management systems, one of the most exciting, new organisational performance improvement techniques.